Strategic Real Estate Investments

Across the United States

Strategic Real Estate Investments Across the United States

Years of Expertise

15+ years of hands-on experience in U.S. real estate investments

Trusted & Transparent

Clear communication, integrity-first approach, and long-term partnerships

Premium Management

Professional management that maximizes asset performance

About Us

Deanaya Investments is a strategic real estate investment firm managing a diversified portfolio of value-add properties across the United States.

Our long-standing track record is built on forward-thinking acquisitions, disciplined asset management, and a commitment to doing business the right way.

We partner with reputable industry leaders who share our dedication to excellence, transparency, and long-term value creation.

our services

Our Investment Focus

We invest in, own, and actively manage a diverse portfolio of real-estate assets across the United States. Our focus includes single-family residential properties as well as commercial assets, specifically office and industrial buildings. By targeting high-quality opportunities in these sectors, we are able to create stable, long-term value while maintaining the flexibility to adapt to shifting market conditions.

Residential

3840 Cromwell Dr Mountain AL Brook Al

A Luxury Home Built From the Ground Up

115 Fairmont Mountain Brook Al

A Luxury Home Built From the Ground Up

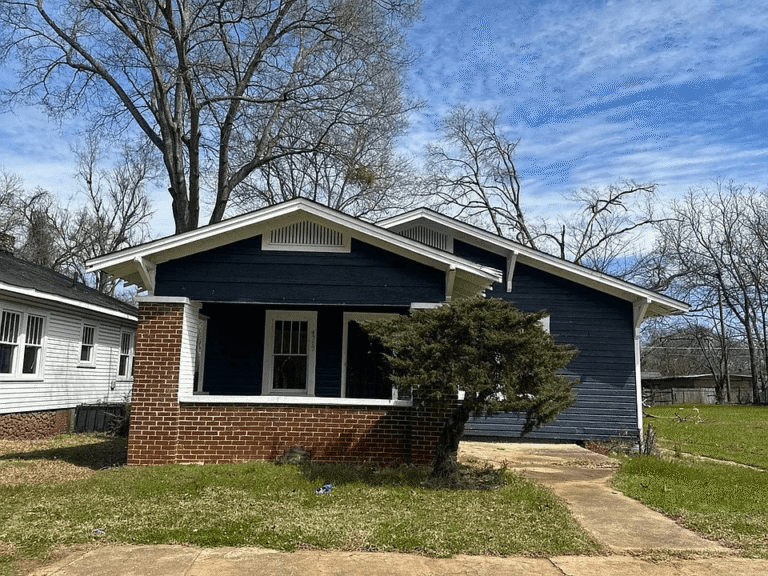

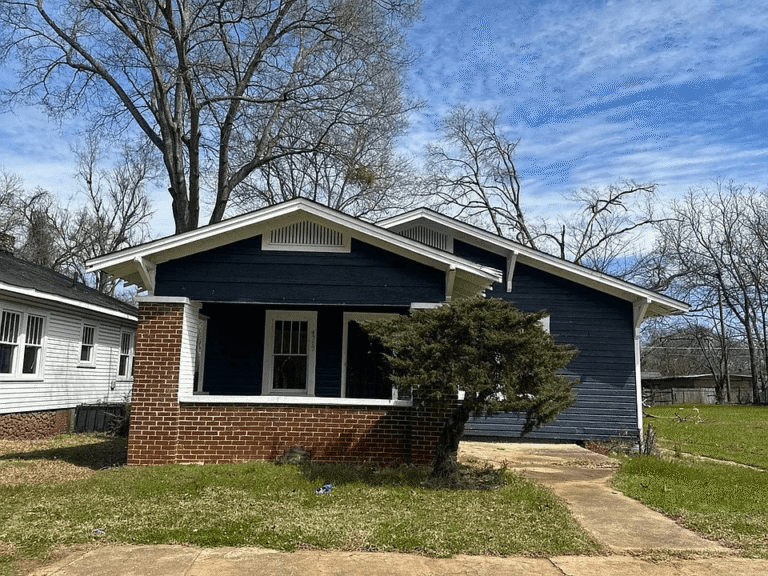

1212 41st St Birmingham Al 35208

Property Value-Add for Sale and Hold

1651 waco ave birmingham AL

Property Value-Add for Sale and Hold

4717 Terrace S Birmingham AL 35208

Property Value-Add for Sale and Hold

4645 avenue u birmingham, al 35208

Property Value-Add for Sale and Hold

3928 Avenue I Birmingham AL

Property Value-Add for Sale and Hold

5300 AVE Birmingham AL 35208

Property Value-Add for Sale and Hold

6817 Division Ave, Birmingham, AL 35206

Property Value-Add for Sale and Hold

2115 Anton Hollywood FL

Property Value-Add for Sale and Hold

2511 SW 58th Fort Lauderdale FL 33312

Property Value-Add for Sale and Hold

2139-2133 Polk Street Hollywood FL

Property Value-Add for Sale and Hold

3120 Avenue I, Birmingham, AL 35218

Property Value-Add for Sale and Hold

3719 Mcciellan Ave Bessemer AL

Property Value-Add for Sale and Hold

Commercial

M500, LLC

Indianapolis, Indiana

334,506 SF, 2 Office building & 1,118

Structural Parking Garage

Acquisition date: Aug 2018

Part of the General Partner and a Minor Equity Holder

Palm Club

160 Multi-housing Units

Lake Worth, Florida

Acquisition date: June 2014

Part of the General Partner and a Minor Equity Holder

Four 700, LLC

Miami, Florida

4-building office complex, Class-A, totaling 289,986 square foot

Acquisition date: Oct 2010

Part of the General Partner and a Minor Equity Holder

Cypress Park West

Florida

Two-building Class A office complex located in the south Florida’s most dynamic and desirable office submarkets – Cypress Creek in Fort Lauderdale

Year Built/Renovated: 1987/ 2007

Acquisition date: Sept 2016

Part of the General Partner and a Minor Equity Holder

445 Penn

445 N Pennsylvania Street, Indianapolis, Indiana

Office building with 1st floor retail in downtown Indianapolis

445 Penn is located adjacent to Indnaya 429 project

Acquisition date: July 2017

Part of the General Partner and a Minor Equity Holder

429 On the Park

Downtown, Indianapolis, Indiana

Trophy Class “A” Office Building

Includes 350 Space Parking Garage

Parcel Size: 1.05 Acres

Acquisition date: February 2015

Part of the General Partner and a Minor Equity Holder

646 Mass

646 Mass Ave, Indianapolis, Indiana.

Property Type: Condo Development

Acquisition date: December 2017

Part of the General Partner and a Minor Equity Holder

Lakeside 6301

6301 NW 5th Way Fort Lauderdale, Florida

Class “A” office asset

Acquisition date: December 2017

Part of the General Partner and a Minor Equity Holder

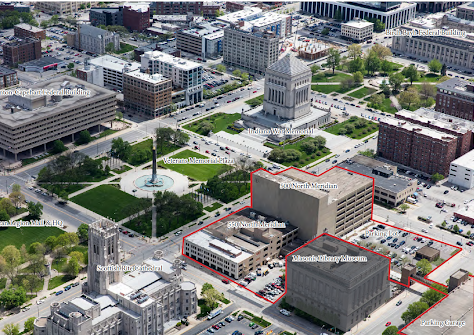

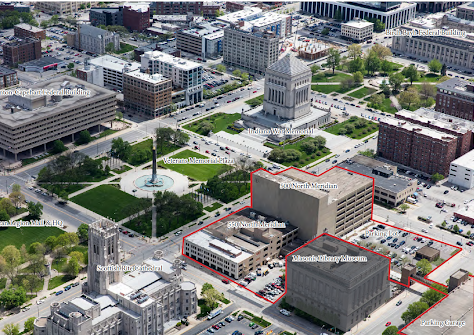

Meridian Portfolio

Indianapolis, Indiana

5 Office Building Portfolio

Acquisition date: Dec 2015

Part of the General Partner and a Minor Equity Holder.

3840 Cromwell Dr Mountain AL Brook Al

A Luxury Home Built From the Ground Up

115 Fairmont Mountain Brook Al

A Luxury Home Built From the Ground Up

1212 41st St Birmingham Al 35208

Property Value-Add for Sale and Hold

1651 waco ave birmingham AL

Property Value-Add for Sale and Hold

4717 Terrace S Birmingham AL 35208

Property Value-Add for Sale and Hold

4645 avenue u birmingham, al 35208

Property Value-Add for Sale and Hold

3928 Avenue I Birmingham AL

Property Value-Add for Sale and Hold

5300 AVE Birmingham AL 35208

Property Value-Add for Sale and Hold

6817 Division Ave, Birmingham, AL 35206

Property Value-Add for Sale and Hold

2115 Anton Hollywood FL

Property Value-Add for Sale and Hold

2511 SW 58th Fort Lauderdale FL 33312

Property Value-Add for Sale and Hold

2139-2133 Polk Street Hollywood FL

Property Value-Add for Sale and Hold

3120 Avenue I, Birmingham, AL 35218

Property Value-Add for Sale and Hold

3719 Mcciellan Ave Bessemer AL

Property Value-Add for Sale and Hold

M500, LLC

Indianapolis, Indiana

334,506 SF, 2 Office building & 1,118

Structural Parking Garage

Acquisition date: Aug 2018

Part of the General Partner and a Minor Equity Holder

Palm Club

160 Multi-housing Units

Lake Worth, Florida

Acquisition date: June 2014

Part of the General Partner and a Minor Equity Holder

Four 700, LLC

Miami, Florida

4-building office complex, Class-A, totaling 289,986 square foot

Acquisition date: Oct 2010

Part of the General Partner and a Minor Equity Holder

Cypress Park West

Florida

Two-building Class A office complex located in the south Florida’s most dynamic and desirable office submarkets – Cypress Creek in Fort Lauderdale

Year Built/Renovated: 1987/ 2007

Acquisition date: Sept 2016

Part of the General Partner and a Minor Equity Holder

445 Penn

445 N Pennsylvania Street, Indianapolis, Indiana

Office building with 1st floor retail in downtown Indianapolis

445 Penn is located adjacent to Indnaya 429 project

Acquisition date: July 2017

Part of the General Partner and a Minor Equity Holder

429 On the Park

Downtown, Indianapolis, Indiana

Trophy Class “A” Office Building

Includes 350 Space Parking Garage

Parcel Size: 1.05 Acres

Acquisition date: February 2015

Part of the General Partner and a Minor Equity Holder

646 Mass

646 Mass Ave, Indianapolis, Indiana.

Property Type: Condo Development

Acquisition date: December 2017

Part of the General Partner and a Minor Equity Holder

Lakeside 6301

6301 NW 5th Way Fort Lauderdale, Florida

Class “A” office asset

Acquisition date: December 2017

Part of the General Partner and a Minor Equity Holder

Meridian Portfolio

Indianapolis, Indiana

5 Office Building Portfolio

Acquisition date: Dec 2015

Part of the General Partner and a Minor Equity Holder.

Looking to explore an opportunity?

Meet our team

Dean Joseph

Founder

Dean Joseph founded Deanaya Investment LLC with a clear mission: to create a results-driven and relationship-focused real estate investment platform. With 15 years of experience spanning real estate investment, finance, and asset management, he leads the firm’s strategy, acquisitions, and portfolio management.

Previously, Dean served as CFO at Naya USA Investment and Management LLC, overseeing a $400M portfolio of commercial and residential assets, including financial leadership, capital management, performance monitoring, and full due diligence. Earlier, he was part of KPMG Israel’s Elite Program as a Financial Management Advisor. Dean is a Certified Public Accountant (CPA) and holds a B.A. in Economics and Accounting from the Hebrew University of Jerusalem.

Bookkeeper & Administrative Manager

Natalia Velasquez

Natalia Velasquez is an accomplished finance and administrative professional with over 25 years of experience supporting senior leadership teams, managing corporate operations, and overseeing full-charge bookkeeping functions across multiple industries.

Natalia holds a BS in International Business from Florida Metropolitan University and a BA in Finance and International Business from Universidad Externado de Colombia.

At Deanaya Investment LLC, Natalia serves as Bookkeeper and Administrative Manager, where she oversees financial operations, maintains accurate and timely reporting, supports administrative workflows, and contributes to the company’s organizational efficiency and strategic growth.